“Nobody gets into crypto for, like, the technology it’s mostly for financial gains,” Zelder said, noting that he wasn’t prepared to evaluate the company’s promises himself.Ĭrypto presents a number of characteristics that appeal to scammers.

At the time that Zelder lost money in the BitConnect collapse, he admitted, he didn’t have great money management skills, and he didn’t fully research the BitConnect project. (Jordan Belfort, the co-founder of Stratton Oakmont - who served 22 months in federal prison for securities fraud and money laundering - is now a self-styled cryptocurrency guru.)Ī common refrain among crypto enthusiasts is “do your own research,” but that doesn’t mean that newcomers are equipped to spot fraud.

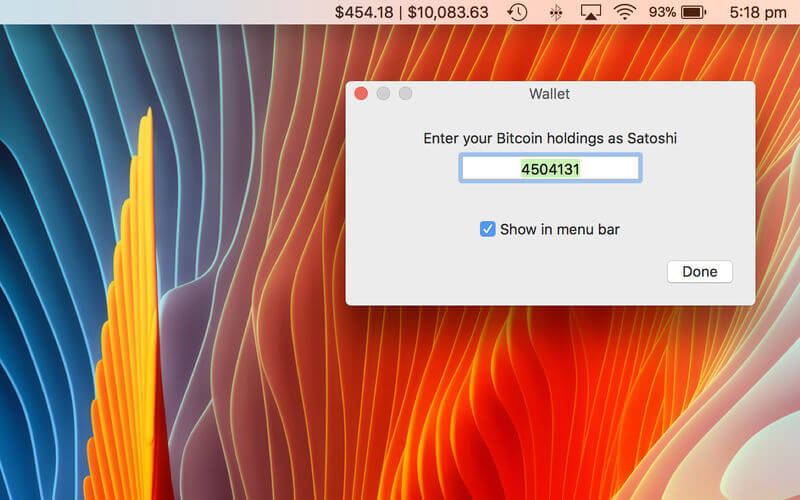

#Bitcoin bar game movie

Take, for example, the 2013 movie “The Wolf of Wall Street” - based on the true story of financial firm Stratton Oakmont engaging in a pump-and-dump scheme to falsely inflate the price of penny stocks. Of course, scams are not unique to crypto - they’ve long succeeded within the confines of the traditional financial system. But the nature of the crypto industry and the patchwork of existing regulations and case precedent make that a complicated proposition. But lawsuits cost a lot of money, which many victims do not have, and can take years to resolve.Īs cryptocurrency scams proliferate, regulators, courts and lawmakers are establishing a framework for holding alleged cryptocurrency scammers responsible.

Victims of cryptocurrency scams can file reports with agencies like the SEC or the FTC or sue alleged crypto fraudsters. Honestly, I’m convinced that just about every crypto could be a scam, and I’m invested pretty big on a lot of these different tokens.”Īs Wall Street slid into a bear market this month, traders began dumping their crypto investments, driving down value and even causing crypto companies like Coinbase, Gemini and to lay off workers.Īs cryptocurrency fraud and theft reports have made headlines and complaints have piled up in recent years, federal regulatory agencies, including the SEC and the Labor and Treasury departments, have begun to assess the risks of the space, issue guidance and enforce applicable laws and regulations. “A lot of these scams are getting very elaborate now, too, so it’s kind of hard to detect. “The knowledge that I have now, back in 2017, I did not have that knowledge, so I was just so confused and trying to figure out answers,” Zelder said. That makes it all the more difficult to sniff out a scam, even for those who’ve profited from crypto investing in the past. Generally speaking, crypto investing is risky, prone to massive swings and often fueled by dramatic hype. A review showed that again and again, investors large and small have been duped by promises of high returns from seemingly legitimate firms using obfuscatory financial instruments. Grid obtained 23,960 complaints about alleged crypto scams filed with the FTC, through a Freedom of Information Act request. The Federal Trade Commission estimates that tens of thousands of Americans have lost a total of $1.18 billion to crypto fraud between 20. Regulators are paying close attention to the proliferation of crypto scams. The founders and their international promoters hyped up BitConnect’s lending program in exchange for a share of the invested funds they obtained - and without disclosing their financial relationship to investors. But, according to prosecutors, Kumbhani and his co-conspirators were running a global Ponzi scheme. BitConnect promoters had promised big returns on investments, pointing new investors to the supposed benefits of BitConnect’s lending program.

0 kommentar(er)

0 kommentar(er)